You know that without the best online payment gateways, you will struggle to compete with your competitors.

Imagine a situation where you visit an online store and purchase any item. Select your favorite product, add it to your basket, and then go to the checkout page. You will now see your well-known or famous payment gateway on the checkout page.

All sales of the store consider eCommerce payment gateways. The client must enter their payment details at the checkout page to complete the transaction.

After that, money is credited after the successful transaction. At this point, the eCommerce store can deposit money into their bank account. An online payment gateway has many advantages. Let’s get to it.

Why is Online Payment Gateways Essential For eCommerce Businesses?

All eCommerce and dropshipping companies function the same way, regardless of whether they are eCommerce or dropshipping. Dropshipping businesses don’t need any inventory, while eCommerce companies might.

Dropships or eCommerce businesses must have a payment gateway to sell their products.

Because there are so many payment options, customers prefer to use the one they know.

This is an important consideration when setting up your payment system. When evaluating your options, choose a secure payment gateway well known to your target audience.

PayPal is a popular and well-known payment processor in the USA. While Payoneer is famous in the Asian continents, Stripe is the preferred payment method on the European continent.

A well-known payment gateway is ideal if you want to reach an international audience.

Ecommerce Business Best Payment Ways

An expert of Hostcano Web hosting has compiled a list of the most used payment methods for eCommerce and dropshipping businesses. Please take a look at our review to make your own decision.

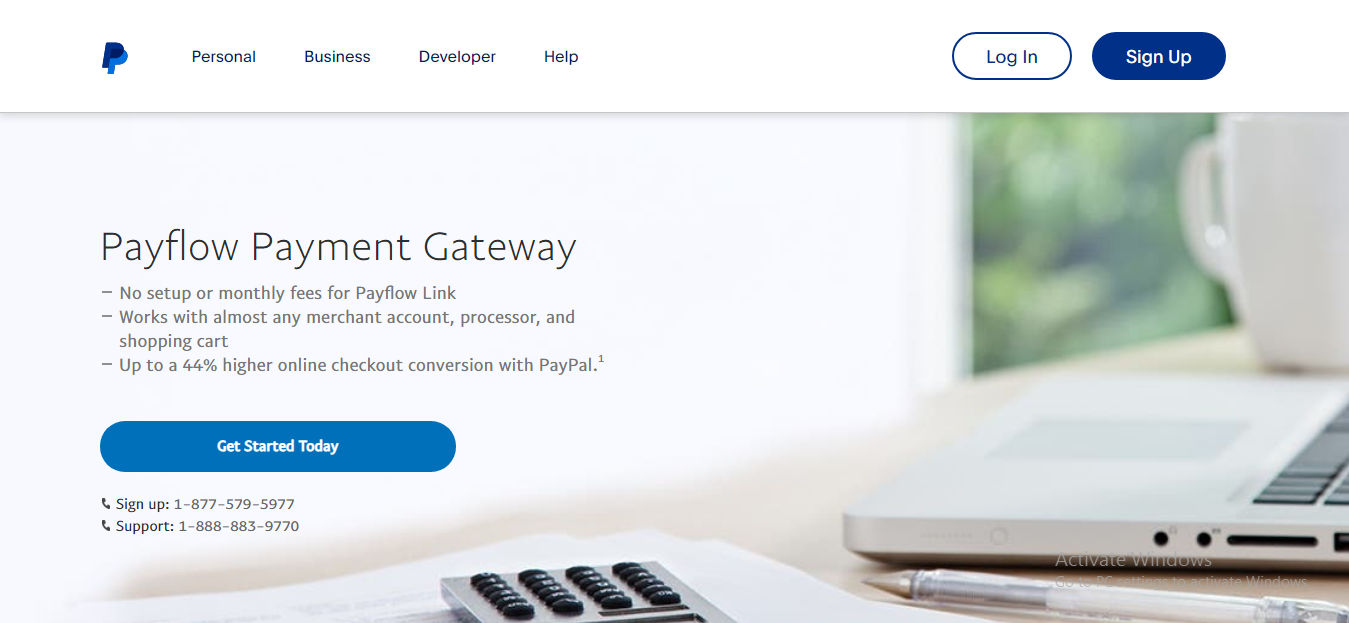

PayPal

PayPal is a modern payment method for online purchases. Two hundred and three countries have accepted it.

This processor accepts Visa, MasterCard, and other major credit cards. You will need a PayPal account to start eCommerce and drop shipping.

Payment Gateway Pricing:

PayPal charges a flat fee of $0.05- $0.49 per transaction, plus a maximum transaction processing fee of 3.5%. It all depends on the transaction amount.

You can expect to pay anywhere from $2.99 to $3.99 for a $100 purchase. These fees aren’t too high. These cumulative costs can reduce your earnings for up to a year.

PayPal charges a 2.99 percent transaction fee and a 49-cent transaction fee for every transaction.

Advance options for debit and credit card payments can be purchased – for an additional fee. Chargeback Protection is available for a fee of up to $0.49 per transaction.

You can save money by reducing the number of features you buy. The higher the cost, the more you will get.

Quick Note: PayPal is not available in all countries. Before you make a decision, check the list of countries.

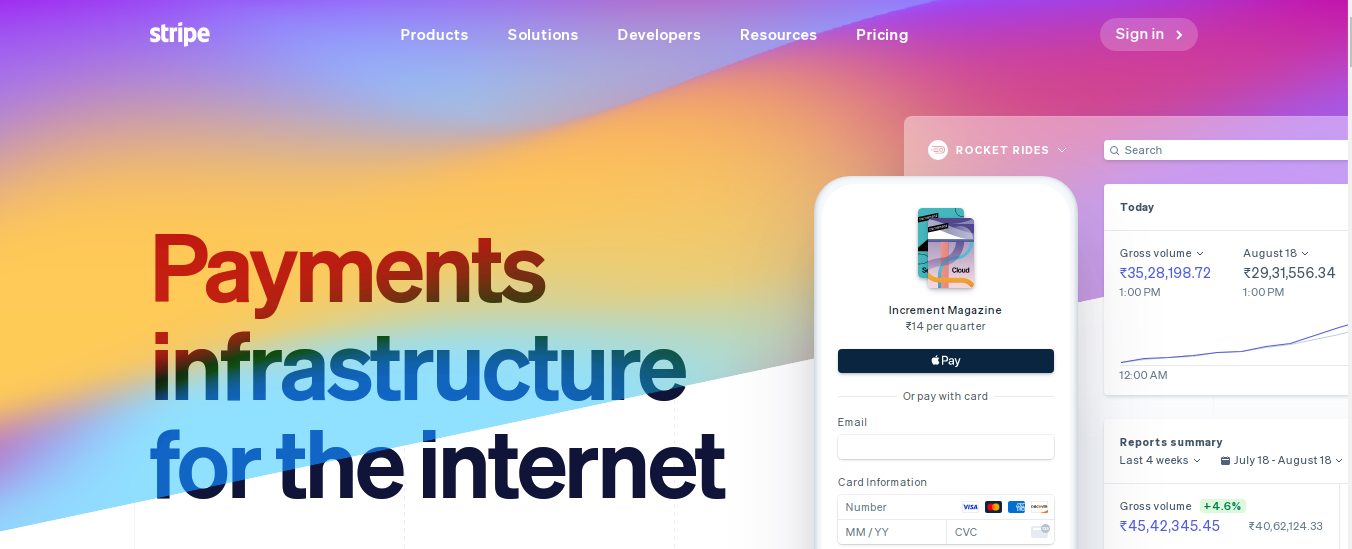

Stripe

Stripe is available in more than 25 countries, including the United States. Stripe accepts payment from almost all major credit cards.

These countries are notable exceptions to the general rule. You can also use this WooCommerce payment processor. A great advantage is the ability to sell products on the Facebook marketplace.

Stripe is an alternative to Easy Digital Downloads’ default payment gateway for WordPress.

ECommerce stores can use the Stripe Pro plugin to process card payments.

If your products are digital, Stripe is the best choice.

Payment Gateway Pricing:

Stripe requires that consumers pay a flat fee for each transaction. Online and in-person transactions cost 2.9% per transaction plus a flat fee (30 cents).

This service is completely free. All prices are based on card processing and transaction costs.

Stripe offers flat-rate pricing models that are easier to understand than card-based pricing.

It is also easy to get started with this payment processor.

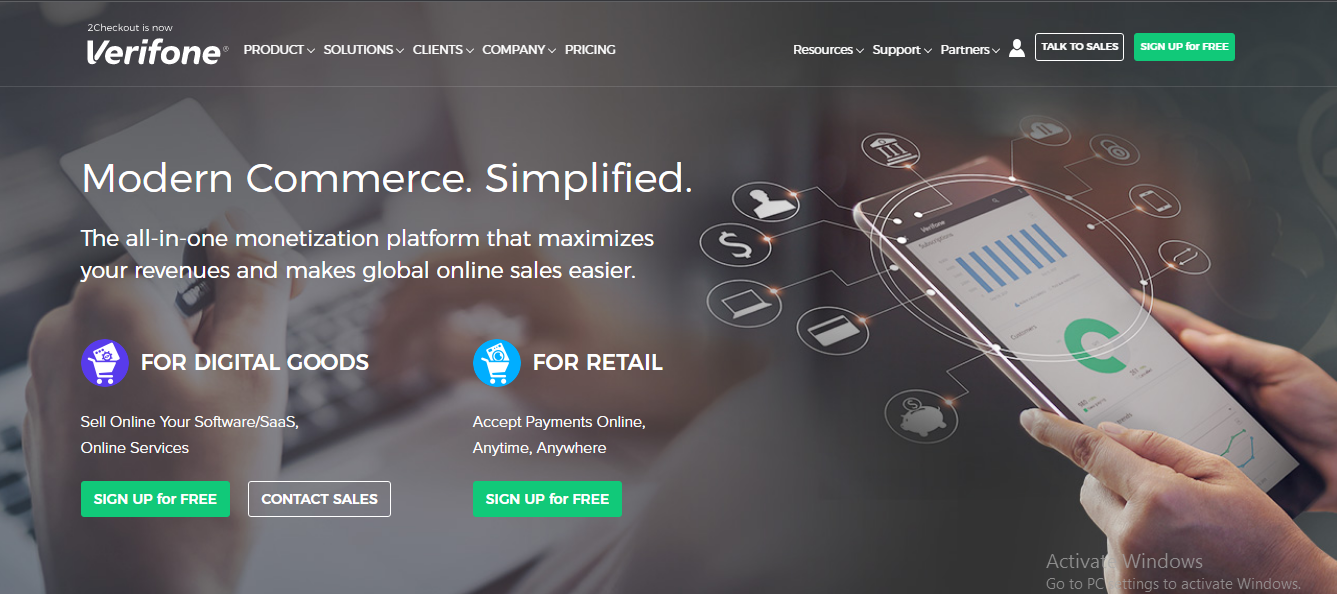

2Checkout

2Checkout can be used in 87 countries around the globe and is now known as Verifone. This processor accepts Visa and MasterCard, but Diners Club and American Express are also acceptable.

This payment gateway allows many countries in the developing world to shop at the eCommerce store.

It can be challenging to find the best payment processors for your needs.

2Checkout can also be linked to platforms like Shopify, WooCommerce, and others.

Payment Gateway Pricing:

2Checkout payment plans will affect the price that you pay. 2Checkout charges a flat fee for most payment methods to keep costs consistent across transactions.

Transaction fees for 2Checkout’s initial product, 2Sell, are 3.5% per transaction plus an additional 35cs. 2Subscribe plan costs 4.5% per transaction plus a flat fee of 45cs. 2Monetize charges 6.5% per transaction with an additional 60cs.

You should review the enterprise plan of any company that has many sales.

Authorize.Net

Access to the internet is available to more than a third-world population. Additionally, online payment channels such as PayPal are well-known to consumers and have been around for a while.

Also included are several WooCommerce-compatible plugins. currently charges 2.90% per transaction and a $0.30 flat fee for dropshipping or e-commerce companies.

Authorize.net is a secure and fast payment gateway that allows you to pay out quickly. Its popularity and widespread use increase client trust.

Because everyone knows it, customers are more likely to shop at an online store that offers safe and reliable payment options.

Credit card payments will encourage customers to return because they feel more secure when shopping, increasing their chances of returning.

Payment Gateway Pricing:

You will be charged a flat $0.10 per transaction and $0.10 per daily batch for Authorize.net. A merchant account costs $25 per month.

Authorize.Net merchant accounts cost 2.9 percent + $0.30 monthly for Authorize.Net resellers with a $25 startup fee. Larger companies can enjoy additional savings, and there is no cancellation or setup fee.

Skrill

Skrill is a payment processor with a global reach in more than 40 countries. After each transaction, a 1.9 percent fee will be added to your account. WooCommerce Dropshipping Shop Integration plugin is also available on the platform.

Skrill was used in the past to store and send earnings from online gambling. Skrill (formerly Moneybookers) offers a variety of goods and services in addition to online gambling.

Register first to use Skrill’s mobile wallet or merchant services (called “payment processing”).

Skrill has many benefits, but the best is Skrill’s simplicity in making and receiving payments across multiple countries.

Firms may use Skrill in high-risk regions to pay their bills.

Payment Gateway Pricing:

All existing features are included at no extra charge. Debit or credit cards are available at 1.2 percent and a flat fee of EUR0 29.

WePay

Dropshipping companies may use WePay to integrate a secure payment option onto their website. However, the WePay payment system can be configured with only a few available payment options.

WePay was established in 2008, one year before its competitors. The app’s original purpose was to enable a decentralized payment system. JPMorgan Chase purchased it in 2017.

Customers of the financial giant can now get their reimbursements on the same day.

The WePay white label API may be used to set up the eCommerce payment process. This alternative payment method is available for people who don’t have PayPal or other popular payment options.

Payment Gateway Pricing:

Customers can purchase with this payment option using their bank transactions without disclosing credit card or debit card information.

Transactions on bank accounts are subject to a 1.5% transaction fee and a $0.30 transaction fee.

WePay’s digital technology allows customers to pay credit or debit cards online as an alternative to Shopify or other payment processing platforms.

These payment options allow businesses to use integrated payment methods, while merchants can transfer their earnings directly into their bank accounts.

Customers pay 2.9 percent per transaction and a flat fee of $0.25.

Google Pay

Google Pay a popular alternative payment method for online shops in western culture is Google Pay. Google Wallet is also used by more people in Europe and the United States to track their finances.

Because their purchases are made online, they can now pay via Google checkout. It is, therefore, the best alternative if you are looking for a faster and more reliable solution.

This means that Google Pay takes less money from the customer’s bank account.

This service allows you to accept online payments via an online seller account. Even though Google is well-known around the globe, it can be used by anyone who uses your eCommerce store. Website owners can use this payment system without hesitation.

It’s a payment option that is similar to PayPal, but it still has its own flavor. Google Checkout is a trusted seller account.

You can use either an XML API (or HTML) to include Google Checkout on your site.

Payment Gateway Pricing:

There are per-transaction fees and a flat fee of $0.30.

- If the monthly sales volume of less than 3000, then the cost per transaction will be 2.9%

- If your monthly sales volume is between $9,999 and $3,000, the transaction cost is 2.5%

- If your monthly sales volume is between 10,000 and $99,999, the cost per transaction will be 2.2%.

- The minimum transaction fee is 1.9% on your monthly sales above $100,000

A 1% fee is applied if the buyer’s billing address differs from the seller’s. It adds $0.30 to each “partially captured” transaction.

Except for Google Grants recipients, all registered non-profit businesses are eligible to pay the same fee.

Square

Square offers online and in-person payment options, a unique feature. It’s an excellent option for businesses that have retail stores and are looking to sell online.

It is suitable for businesses that plan to open retail locations along with your eCommerce store. Square charges merchants a nominal fee, just like Stripe and PayPal. It’s easy to integrate Square into your eCommerce site.

Square is one of the most popular eCommerce payment gateways. It allows merchants to accept online and offline payments from any device.

Square has a partnership with many well-known eCommerce companies like WooCommerce and OpenCart, as well as Magento, WordPress, WooCommerce, WooCommerce, OpenCart, and Magento. Square charges $60 per location a month. Plus, a 2.5% fee and $.10 per swipe.

Wrapping up

Both merchants and customers can reap the benefits of payment gateways. Business owners can benefit from choosing the right payment gateway. Many merchants also agree with the advantages of a payment portal for their business, mainly when it facilitates the buying process for customers and encourages them to buy more.

There are three types of payment gateways. In addition, people pay more attention today to security because more transactions are made online, and cybercriminals are more deadly than ever.

In addition, the best payment gateway for eCommerce businesses will make your business more secure and efficient.